Costs Associated with Inventories

The costs that are affected (i.e., increase or decrease) by the firm’s decision to maintain a particular level of inventory are called costs associated with inventories or relevant inventory costs.

These relevant inventory costs play an important role in the study of an inventory system. These costs may be classified as:

Total costs consist of:

(i) Purchase cost

(ii) Ordering cost

(iii) Inventory carrying cost

(iv) Shortage cost.

Total cost : The total cost is given by

Total cost = Purchase cost + Total variable cost of managing the inventory (TVC)

= Purchase cost + Inventory carrying cost + Ordering cost + Shortage cost.

1. Purchase Cost (Production cost) : If unit cost of an item depends on the quantity of purchase, i.e., price discounts are available, then it is necessary to formulate an inventory policy which takes into consideration the purchase cost of the item held in stock also. The cost of purchasing or producing a unit of an item is called as purchase cost (production cost). It is the actual price paid for the procurement of items. Its unit of measurement is in ` per unit. The unit price of an item depends on the size of the quantity of purchase (or manufactured). It is given by the relation:

Purchase cost = Price per unit × Demand per unit time

= C × D

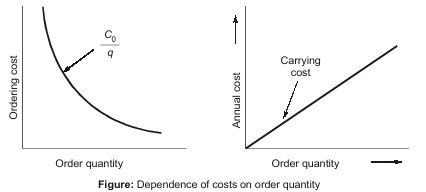

2. Ordering Cost (Inventory procurement cost): Ordering costs is the cost associated with replenishing the stock of inventory being held. This is generally expressed as the money spent per order and is independent of the order size. Annual ordering cost vary with the number of orders made- as the number of orders increase, the ordering cost increases. In general, any cost that increases linearly with the number of orders is an ordering cost. Costs incurred each time an order is made can include requisition and purchase orders, transportation and shipping, receiving, inspection, handling, accounting and auditing costs.

Ordering costs react inversely to carrying costs. As the size of orders increases, fewer orders are required, reducing order costs. However, ordering larger amounts results in higher inventory levels and higher carrying costs. In general, as the order size increases, ordering costs decrease and carrying costs increase.

If “C0” is the cost of placing an order and Q the order quantity, then the unit cost of placing an order = Co/Q.

If D = annual demand/requirement, then annual cost of ordering = Co/Q x D

Set-up cost: This is the cost associated with the setting up of machinery before starting production. It is generally assumed to be independent of the quantity produced.

3. Carrying cost: Carrying cost is the cost of holding items in inventory. This cost varies with the level of inventory in stock and occasionally with the length of time an item is held. That is, the greater the level of inventory over a period of time, the higher the carrying costs. In general, any cost that grows linearly with the number of units in stock is a carrying cost. It is based on average inventory and consists of:

- Storage cost.

- Cost of obsolescence: If too much inventory is there in the course of time the product may lease its demand.

- Cost of deterioration and spoilage etc.

- Cost of insurance.

- Cost of capital (interest lost on capital invested).

- Sometimes special tax is to be paid for storing certain items.

- Cost of pilferage (theft) and employing a person for safety.

Carrying costs are normally specified in two ways. The usual way is to assign total carrying costs, determined by summing all the individual costs just mentioned, on a per-unit basis per time period, such as a month or year. In this form, carrying costs are commonly expressed as a per-unit rupee amount on an annual basis; for example, Rs 10 per unit per year. Alternatively, carrying costs are sometimes expressed as a percentage of the value of an item or as a percentage of average inventory value. It is generally estimated that carrying costs range from 10 to 40% of the value of a manufactured item.

Assuming that the inventory decreases through use or sale at a constant rate from the order quantity to zero and then replenished by another order quantity, the average inventory is equal to Q/2, carrying costs are based on this average.

4. Shortage Cost or Stock Out Cost: When an item cannot be supplied on the consumer’s demand, the penalty cost for running out of stock is called shortage cost or stock out cost.

If the item is not in stock, some of the customers are not ready to wait and, therefore, there is a loss of sale. In this case, the shortage cost includes the loss of potential profit on each unit of the item demanded but were not available and loss of goodwill, in terms of permanent loss of customers and it’s associated lost profit for future sales.

<< Previous | Next >>

Must Read: What is Industrial Engineering?

Dear Aspirants,

Your preparation for GATE, ESE, PSUs, and AE/JE is now smarter than ever — thanks to the MADE EASY YouTube channel.

This is not just a channel, but a complete strategy for success, where you get toppers strategies, PYQ–GTQ discussions, current affairs updates, and important job-related information, all delivered by the country’s best teachers and industry experts.

If you also want to stay one step ahead in the race to success, subscribe to MADE EASY on YouTube and stay connected with us on social media.

MADE EASY — where preparation happens with confidence.

MADE EASY is a well-organized institute, complete in all aspects, and provides quality guidance for both written and personality tests. MADE EASY has produced top-ranked students in ESE, GATE, and various public sector exams. The publishing team regularly writes exam-related blogs based on conversations with the faculty, helping students prepare effectively for their exams.